莫里数学线指标是基于甘恩水平概念的一种交易工具,莫里数学线是甘恩方法的一种衍生,使用一套分割价格区间的系统,旨在预测市场价格的支撑位和阻力位。

莫里数学线的基本工作原理如下:

- 层级:该指标将价格范围划分为多个相等的段,每个段代表潜在的支撑或阻力水平。

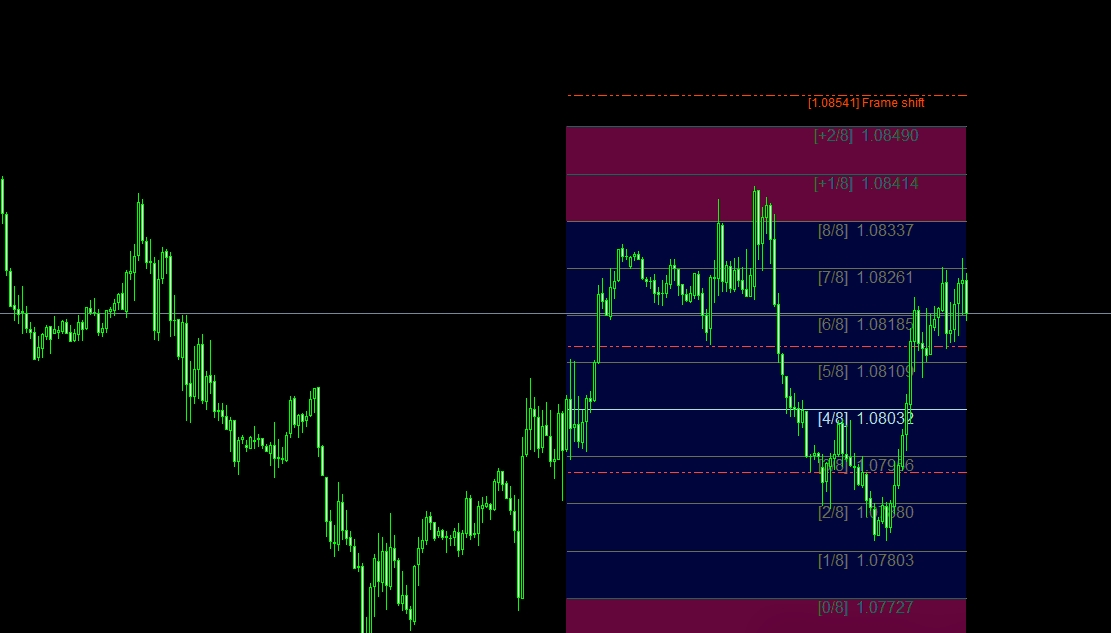

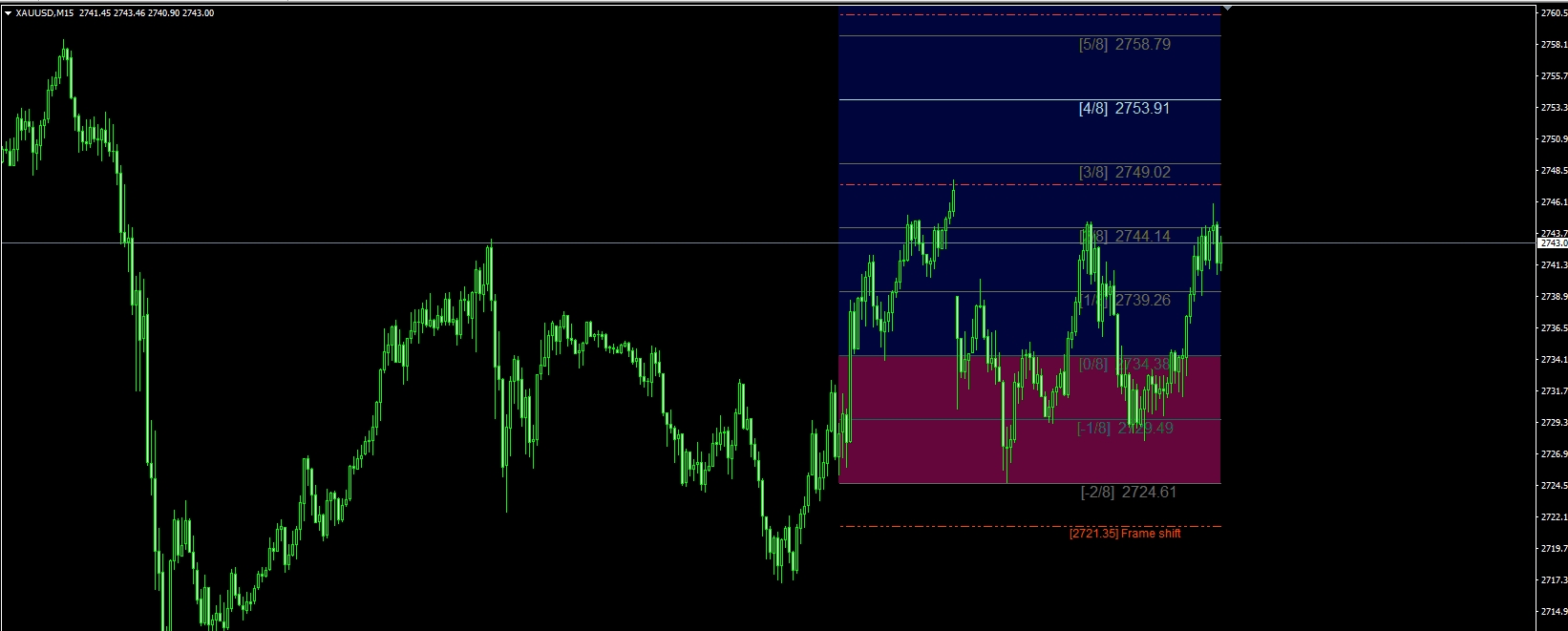

- 八度:这些层级通常被组织成八度,每个八度包含8条线(从0/8到8/8)。这些层级是基于过去市场价格的设定范围计算的。

- 关键点:八度中的某些层级更为重要,例如4/8线通常代表主要的支撑/阻力水平。而8/8线和0/8线被视为最强的阻力和支撑水平。

- 交易:交易者可能使用这些层级来做出进场或出场的决策。例如,价格突破某一莫里线可能表明趋势强劲,而价格难以突破某一线可能表示存在阻力或可能的反转。

这些线条旨在利用市场的周期性,提供对潜在转折点的洞察。交易者通常会根据特定市场或时间框架来自定义回顾期和范围。

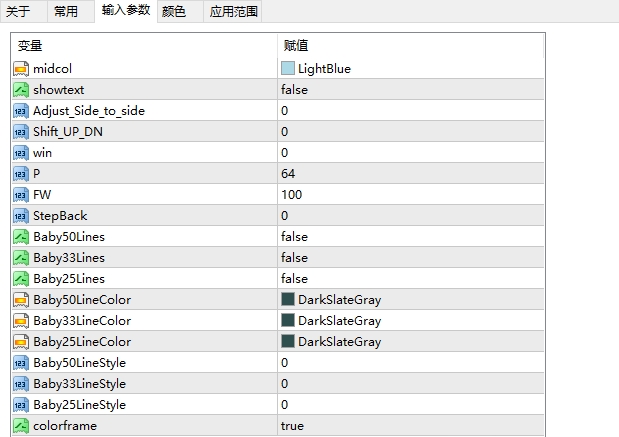

参数:

部分代码展示:

property version "2.02"

property description "———————————————"

property description "EA、指标公式分享"

property description "EA、

property description "———————————————"

property description "———————————————"

property indicator_chart_window

//+——————————————————————+

extern color midcol = LightBlue;

extern bool showtext=false;

extern int Adjust_Side_to_side = 0;

extern int Shift_UP_DN = 0;

extern int win = 0;

double s1[];

extern int P = 64;

extern int FW = 100;

extern int StepBack = 0;

bool showcomments=false;

//+——————————————————————+

extern bool Baby50Lines=false;

extern bool Baby33Lines=false;

extern bool Baby25Lines=false;

extern color Baby50LineColor=DarkSlateGray;

extern color Baby33LineColor=DarkSlateGray;

extern color Baby25LineColor=DarkSlateGray;

extern int Baby50LineStyle=0;

extern int Baby33LineStyle=0;

extern int Baby25LineStyle=0;

//+——————————————————————+

extern bool colorframe=true;

color MM1Color = C’0,6,60′;

color MM2Color = C’100,5,60′;

color MM3Color = C’0,6,60′;

//+——————————————————————+

define FF1 "FF1"

define FF2 "FF2"

define FF3 "FF3"

define FF4 "FF4"

define FF5 "FF5"

//+——————————————————————+

double dmml = 0,

dvtl = 0,

sum = 0,

v1 = 0,

v2 = 0,

mn = 0,

mx = 0,

x1 = 0,

x2 = 0,

x3 = 0,

x4 = 0,

x5 = 0,

x6 = 0,

y1 = 0,

y2 = 0,

y3 = 0,

y4 = 0,

y5 = 0,

y6 = 0,

octave = 0,

fractal = 0,

range = 0,

finalH = 0,

finalL = 0,

mml[13];

//+——————————————————————+

string ln_txt[13], ln_tx[13],

buff_str = "";

//+——————————————————————+

int

bn_v1 = 0,

bn_v2 = 0,

OctLinesCnt = 13,

mml_thk = 8,

mml_wdth[13],

mml_clr[13],

mml_shft = 3,

nTime = 0,

CurPeriod = 0,

nDigits = 0,

i = 0;

//+——————————————————————+

int init() {

//—- indicators

ln_txt[0] = " [-2/8] ";// "extremely overshoot [-2/8]";// [-2/8]

ln_txt[1] = "[-1/8] ";// "overshoot [-1/8]";// [-1/8]

ln_txt[2] = "[0/8] ";// "Ultimate Support – extremely oversold [0/8]";// [0/8]

ln_txt[3] = "[1/8] ";// "Weak, Stall and Reverse – [1/8]";// [1/8]

ln_txt[4] = "[2/8] ";// "Pivot, Reverse – major [2/8]";// [2/8]

ln_txt[5] = "[3/8] ";// "Bottom of Trading Range – [3/8], if 10-12 bars then 40% Time. BUY Premium Zone";//[3/8]

ln_txt[6] = "[4/8] ";// "Major Support/Resistance Pivotal Point [4/8]- Best New BUY or SELL level";// [4/8]

ln_txt[7] = "[5/8] ";// "Top of Trading Range – [5/8], if 10-12 bars then 40% Time. SELL Premium Zone";//[5/8]

ln_txt[8] = "[6/8] ";// "Pivot, Reverse – major [6/8]";// [6/8]

ln_txt[9] = "[7/8] ";// "Weak, Stall and Reverse – [7/8]";// [7/8]

ln_txt[10] = "[8/8] ";// "Ultimate Resistance – extremely overbought [8/8]";// [8/8]

ln_txt[11] = "[+1/8] ";// "overshoot [+1/8]";// [+1/8]

ln_txt[12] = "[+2/8] ";// "extremely overshoot [+2/8]";// [+2/8]

//+——————————————————————+

mml_wdth[0] = 0;

mml_wdth[1] = 0;

mml_wdth[2] = 0;

mml_wdth[3] = 0;

mml_wdth[4] = 0;

mml_wdth[5] = 0;

mml_wdth[6] = 0;

mml_wdth[7] = 0;

mml_wdth[8] = 0;

mml_wdth[9] = 0;

mml_wdth[10] = 0;

mml_wdth[11] = 0;

mml_wdth[12] = 0;

//+——————————————————————+

ln_tx[0] = "";

ln_tx[1] = "";

ln_tx[2] = "";

ln_tx[3] = "";

ln_tx[4] = "";

ln_tx[5] = "";

ln_tx[6] = "";

ln_tx[7] = "";

ln_tx[8] = "";

ln_tx[9] = "";

ln_tx[10] = "";

ln_tx[11] = "";

ln_tx[12] = "";

//+——————————————————————+

mml_shft = 0;//original was 3

mml_thk = 3;

//+——————————————————————+

mml_clr[0] = DimGray;//Maroon; // [-2]/8

mml_clr[1] = DimGray;//C’60,60,60′; // [-1]/8

mml_clr[2] = DimGray;//Red; // [0]/8

mml_clr[3] = DimGray;//C’60,60,60′; // [1]/8

mml_clr[4] = DimGray;//DarkGreen; // [2]/8

mml_clr[5] = DimGray;//C’60,60,60′; // [3]/8

mml_clr[6] = midcol;//Lavender; // [4]/8

mml_clr[7] = DimGray;//C’60,60,60′; // [5]/8

mml_clr[8] = DimGray;//DarkGreen; // [6]/8

mml_clr[9] = DimGray;//C’60,60,60′; // [7]/8

mml_clr[10] = DimGray;//Red; // [8]/8

mml_clr[11] = DimGray;//C’60,60,60′;//DarkViolet; // [+1]/8

mml_clr[12] = DimGray;//Maroon;//LightSlateGray; // [+2]/8

//+——————————————————————+

return(0);

}

//+——————————————————————+

int deinit() {

//—- TODO: add your code here

Comment(" ");

//+——————————————————————+

for(i=0;i<OctLinesCnt;i++) {

buff_str = "mml"+i;

ObjectDelete(buff_str);

buff_str = "mml_txt"+i;

ObjectDelete(buff_str);

}

//—- Screen Background

ObjectDelete(FF1);

ObjectDelete(FF2);

ObjectDelete(FF3);

ObjectDelete(FF4);

ObjectDelete(FF5);

//—-

ObjectsDeleteAll(0,OBJ_TREND);

ObjectsDeleteAll(0,OBJ_TEXT);

ObjectsDeleteAll(0,OBJ_LABEL);

ObjectsDeleteAll(0,OBJ_VLINE);

return(0);

}

//+——————————————————————+

int start(){

double r;

int m,s;

m=Time[0]+Period()*60-CurTime();

r=m/60.0;

s=m%60;

m=(m-m%60)/60;

if (showtext) {

ObjectDelete("xard1");

ObjectCreate("xard1", OBJ_LABEL, win, 0, 0);

ObjectSetText("xard1",m+":"+s , 25, "Gungsuh", Silver);

ObjectSet("xard1", OBJPROP_CORNER, 1);

ObjectSet("xard1", OBJPROP_XDISTANCE, 300);

ObjectSet("xard1", OBJPROP_YDISTANCE, 5);

ObjectCreate("Xdb", OBJ_LABEL, win, 0, 0);

ObjectSetText("Xdb",Symbol(),25, "Gungsuh", Silver);

ObjectSet("Xdb", OBJPROP_CORNER, 1);

ObjectSet("Xdb", OBJPROP_XDISTANCE, Adjust_Side_to_side + 140);

ObjectSet("Xdb", OBJPROP_YDISTANCE, Shift_UP_DN + 5);

ObjectDelete("xard2");

ObjectCreate("xard2", OBJ_LABEL, win, 0, 0);

ObjectSetText("xard2",DoubleToStr(Bid,Digits) , 25, "Gungsuh", Silver);

ObjectSet("xard2", OBJPROP_CORNER, 1);

ObjectSet("xard2", OBJPROP_XDISTANCE, Adjust_Side_to_side + 10);

ObjectSet("xard2", OBJPROP_YDISTANCE, Shift_UP_DN + 5);

}