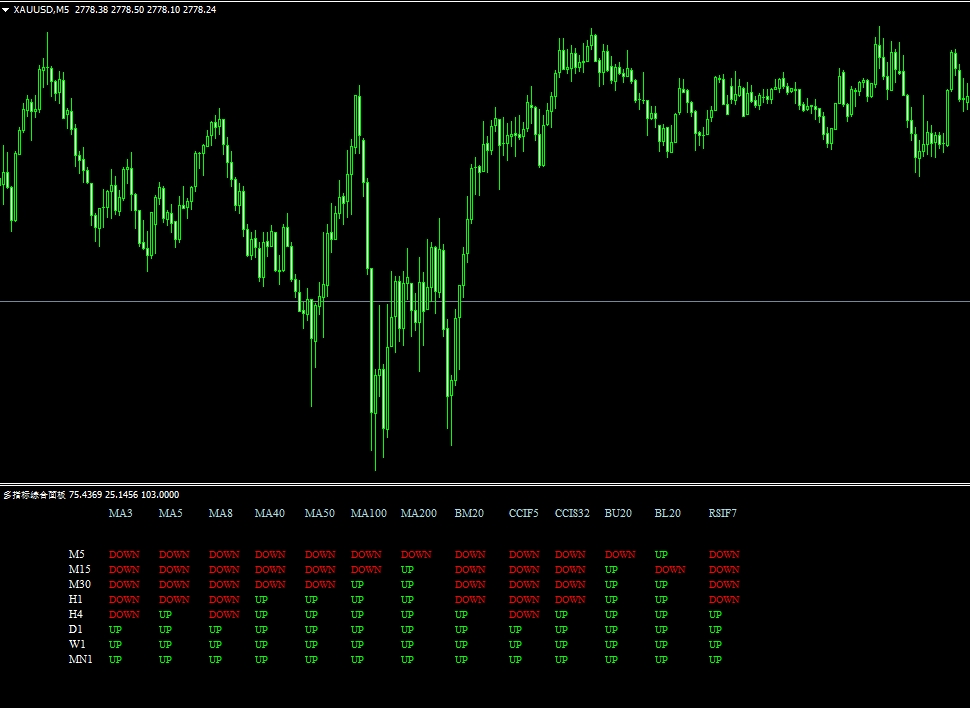

指标名称:多指标综合面板

版本:MT4 ver. 2.03

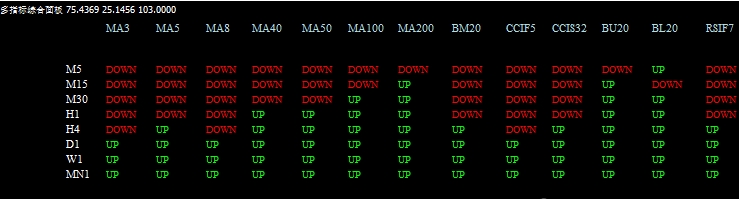

多指标综合面板是一个包含多个指标多个周期显示信号方向的指标面板。主要包含指标:多组MA均线,CCI指标,布林指标,RSI指标

包含周期:5分钟,15分钟,30分钟,1小时,4小时,1天,1周,1月

信号多头,采用绿色UP字样,空头采用:红色DOWN字样。

指标和之前发布的:交易导航仪(Trade Navigator)功能类似,但是比其更丰富,可以相互借鉴使用。

参考:

交易导航仪(Trade Navigator),多指标多周期信号展示面板!支持邮件提醒!免费公式!(指标教程)

参数:

//+——————————————————————+

//| 多指标综合面板_v2.3.mq4 |

//| Copyright © 2009-2024, http://www.QChaos.com |

//| https://www.qchaos.com/ |

//+——————————————————————+

property copyright "Copyright © 量化混沌, http://www.qchaos.com"

property link "https://www.qchaos.com"

property version "2.03"

property description "———————————————"

property description "EA、指标公式分享"

property description "EA、指标编写业务承接"

property description "———————————————"

property description "更多资源,关注公众号:量化程序"

property description "微 信:QChaos001"

property description "手机号:134-8068-5281"

property description "———————————————"

// 1. In this version, you can choose which indicators and TF you want to calculate the trend

property indicator_separate_window

property indicator_minimum 0

property indicator_maximum 1

property indicator_buffers 3

property indicator_color1 Lime

property indicator_color2 Red

//—- buffers

double UPBuffer[];

double DOWNBuffer[];

double FLATBuffer[];

double CountBuffer[];

//—- For the small screens

string Display_infos = "=== If true, displayed on the chart ==="; // 说明是否在图表上显示信息

bool display_on_chart = false; // 若为true,则在图表窗口中显示开盘交易分析、每日枢轴点和日内区间

//—- Open trade info parameters

string Trade_info = "=== Trade Info ==="; // 显示“交易信息”部分

bool AccountMini = true; // 若为false,则账户为标准账户

double LeverageToTrade = 50; // 交易杠杆(例如,账户为200:1,你想使用10:1杠杆,则填10)

double PipValue = 5; // 每点的价值

//—- Indicators to display and calculate the trend

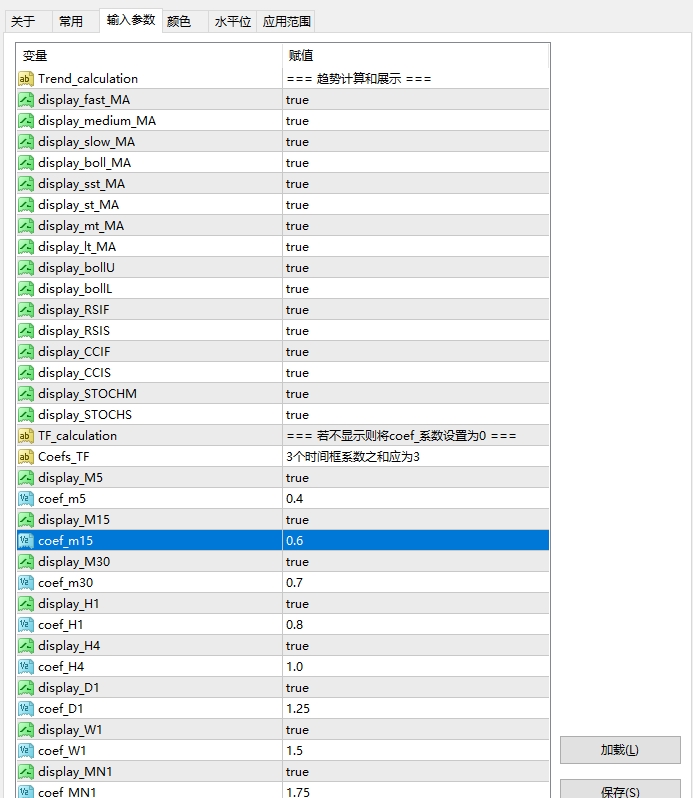

extern string Trend_calculation = "=== 趋势计算和展示 ==="; // 显示“趋势计算和显示”部分

extern bool display_fast_MA = true; // 显示快速移动平均线

extern bool display_medium_MA = true; // 显示中等速度的移动平均线

extern bool display_slow_MA = true; // 显示慢速移动平均线

extern bool display_boll_MA = true; // 显示布林带移动平均线

extern bool display_sst_MA = true; // 显示短期趋势

extern bool display_st_MA = true; // 显示短期移动平均线

extern bool display_mt_MA = true; // 显示中期移动平均线

extern bool display_lt_MA = true; // 显示长期移动平均线

extern bool display_bollU = true; // 显示布林带上轨

extern bool display_bollL = true; // 显示布林带下轨

extern bool display_RSIF = true; // 显示RSI7指标

extern bool display_RSIS = true; // 显示RSI21指标

extern bool display_CCIF = true; // 显示CCI5指标

extern bool display_CCIS = true; // 显示CCI25指标

extern bool display_STOCHM = true; // 显示随机指标主线

extern bool display_STOCHS = true; // 显示随机指标信号线

//—- Timeframes to display and calculate the trend

extern string TF_calculation = "=== 若不显示则将coef_系数设置为0 ==="; // 若不显示则将系数设置为0

extern string Coefs_TF = "3个时间框系数之和应为3"; // 3个时间框系数之和应为3

extern bool display_M5 = true; // 显示5分钟时间框

extern double coef_m5 = 0.4; // 5分钟系数

extern bool display_M15 = true; // 显示15分钟时间框

extern double coef_m15 = 0.6; // 15分钟系数

extern bool display_M30 = true; // 显示30分钟时间框

extern double coef_m30 = 0.7; // 30分钟系数

extern bool display_H1 = true; // 显示1小时时间框

extern double coef_H1 = 0.8; // 1小时系数

extern bool display_H4 = true; // 显示4小时时间框

extern double coef_H4 = 1; // 4小时系数

extern bool display_D1 = true; // 显示日线时间框

extern double coef_D1 = 1.25; // 日线系数

extern bool display_W1 = true; // 显示周线时间框

extern double coef_W1 = 1.5; // 周线系数

extern bool display_MN1 = true; // 显示月线时间框

extern double coef_MN1 = 1.75; // 月线系数

//—- Indicators parameters

string Shift_Settings_test_only = "=== Format: 2024.1.01 00:00 ==="; // 测试用的时间格式

datetime look_time_shift = D’2024.01.01 00:00′; // 若测试为真,则为测试时间

double shift_indicators = 0; // 若测试为假,则为指标偏移

bool test = false; // 是否启用测试模式

string Boll_Settings = "=== Bollinger Band Settings ==="; // 布林带设置部分

int bollMAPeriod = 20; // 布林带中线周期

int bollMAMode = MODE_SMA; // 布林带移动平均方法(简单移动平均)

int bollprice = PRICE_CLOSE; // 布林带计算价格

int bollmodeup = MODE_UPPER; // 布林带上轨

int bollmodedn = MODE_LOWER; // 布林带下轨

int bollshift = 0; // 布林带移位

int bolldev = 2; // 布林带标准差倍数

string MA_Settings = "=== Moving Average Settings ==="; // 移动平均设置部分

int FastMAPeriod = 3; // 快速移动平均周期

int FastMAMethod = MODE_EMA; // 快速移动平均方法(指数移动平均)

int MediumMAPeriod = 5; // 中等移动平均周期

int SlowMAPeriod = 8; // 慢速移动平均周期

int MAMethod = MODE_SMA; // 移动平均方法(简单移动平均)

int MAPrice = PRICE_CLOSE; // 移动平均价格

// 移动平均设置

int sstMAPeriod = 40; // 次慢速移动平均周期

int sstMAMethod = MODE_SMA; // 次慢速移动平均方法

int sstMAPrice = PRICE_CLOSE; // 次慢速移动平均价格

int stMAPeriod = 50; // 慢速移动平均周期

int stMAMethod = MODE_SMA; // 慢速移动平均方法

int stMAPrice = PRICE_CLOSE; // 慢速移动平均价格

int mtMAPeriod = 100; // 中期移动平均周期

int mtMAMethod = MODE_SMA; // 中期移动平均方法

int mtMAPrice = PRICE_CLOSE; // 中期移动平均价格

int ltMAPeriod = 200; // 长期移动平均周期

int ltMAMethod = MODE_SMA; // 长期移动平均方法

int ltMAPrice = PRICE_CLOSE; // 长期移动平均价格

string CCIFast_Settings = "=== CCI Fast Settings ==="; // 快速CCI设置部分

int CCIFastPeriod = 5; // 快速CCI周期

int CCIFastPrice = PRICE_WEIGHTED; // 快速CCI价格

string CCISlow_Settings = "=== CCI Settings ==="; // 慢速CCI设置部分

int CCISlowPeriod = 32; // 慢速CCI周期

int CCISlowPrice = PRICE_WEIGHTED; // 慢速CCI价格

string RSIFast_Settings = "=== RSI Fast Settings ==="; // 快速RSI设置部分

int RSIFastPeriod = 7; // 快速RSI周期

int RSIFastPrice = PRICE_CLOSE; // 快速RSI价格

/

string RSISlow_Settings = "=== RSI Settings ==="; // 慢速RSI设置部分

int RSISlowPeriod = 14; // 慢速RSI周期

int RSISlowPrice = PRICE_CLOSE; // 慢速RSI价格

/

/*

string MACD_Settings = "=== MACD Settings ===";

int MACDFast = 12; // MACD fast EMA period

int MACDSlow = 26; // MACD slow EMA period

int MACDSignal = 9; // MACD signal SMA period

string ADX_Settings = "=== ADX Settings ===";

int ADXPeriod = 14; // Average Directional movement period

int ADXPrice = PRICE_CLOSE; // ADX price

string BULLS_Settings = "=== BULLS Settings ===";

int BULLSPeriod = 13; // Bulls Power period

int BULLSPrice = PRICE_CLOSE; // Bulls Power price

string BEARS_Settings = "=== BEARS Settings ===";

int BEARSPeriod = 13; // Bears Power period

int BEARSPrice = PRICE_CLOSE; // Bears Power price

*/

// if ((iStochastic(NULL, NULL,14,3,2,MODE_SMA,0,MODE_MAIN,current)

//iStochastic(NULL, NULL,14,3,2,MODE_SMA,0,MODE_SIGNAL,current)

//iBands(NULL, NULL,20,2,0,PRICE_CLOSE,MODE_UPPER,current)

//iBands(NULL, NULL,20,2,0,PRICE_CLOSE,MODE_UPPER,current)

//iRSI(NULL, NULL,7,PRICE_CLOSE,current) > iCCI(NULL, NULL,5,PRICE_CLOSE,current)

//+——————————————————————+

//| Custom indicator initialization function |

//+——————————————————————+

int init()

{

//—- name for indicator window

string short_name="多指标综合面板";

IndicatorShortName(short_name);

SetIndexBuffer(0,UPBuffer);

SetIndexBuffer(1,DOWNBuffer);

SetIndexBuffer(2,CountBuffer);

//—-

return(0);

}

//+——————————————————————+

//| Custom indicator deinitialization function |

//+——————————————————————+

int deinit()

{

//—-

ObjectDelete("timeframe");

ObjectDelete("line1");

ObjectDelete("stoploss");

ObjectDelete("Stop");

ObjectDelete("pipstostop");

ObjectDelete("PipsStop");

ObjectDelete("line2");

ObjectDelete("pipsprofit");

ObjectDelete("pips_profit");

ObjectDelete("percentbalance");

ObjectDelete("percent_profit");

ObjectDelete("line3");

ObjectDelete("maxlot1");

ObjectDelete("maxlot2");

ObjectDelete("line4");

ObjectDelete("Trend_MAfast_5");

ObjectDelete("Trend_MAfast_15");

ObjectDelete("Trend_MAfast_30");

ObjectDelete("Trend_MAfast_60");

ObjectDelete("Trend_MAfast_240");

ObjectDelete("Trend_MAfast_1440");

ObjectDelete("Trend_MAfast_10080");

ObjectDelete("Trend_MAfast_43200");

ObjectDelete("Trend_MAmedium_5");

ObjectDelete("Trend_MAmedium_15");

ObjectDelete("Trend_MAmedium_30");

ObjectDelete("Trend_MAmedium_60");

ObjectDelete("Trend_MAmedium_240");

ObjectDelete("Trend_MAmedium_1440");

ObjectDelete("Trend_MAmedium_10080");

ObjectDelete("Trend_MAmedium_43200");

ObjectDelete("Trend_MAslow_5");

ObjectDelete("Trend_MAslow_15");

ObjectDelete("Trend_MAslow_30");

ObjectDelete("Trend_MAslow_60");

ObjectDelete("Trend_MAslow_240");

ObjectDelete("Trend_MAslow_1440");

ObjectDelete("Trend_MAslow_10080");

ObjectDelete("Trend_MAslow_43200");

ObjectDelete("Trend_MAsst_5");

ObjectDelete("Trend_MAsst_15");

ObjectDelete("Trend_MAsst_30");

ObjectDelete("Trend_MAsst_60");

ObjectDelete("Trend_MAsst_240");

ObjectDelete("Trend_MAsst_1440");

ObjectDelete("Trend_MAsst_10080");

ObjectDelete("Trend_MAsst_43200");

ObjectDelete("Trend_MAst_5");

ObjectDelete("Trend_MAst_15");

ObjectDelete("Trend_MAst_30");

ObjectDelete("Trend_MAst_60");

ObjectDelete("Trend_MAst_240");

ObjectDelete("Trend_MAst_1440");

ObjectDelete("Trend_MAst_10080");

ObjectDelete("Trend_MAst_43200");

ObjectDelete("Trend_MAmt_5");

ObjectDelete("Trend_MAmt_15");

ObjectDelete("Trend_MAmt_30");

ObjectDelete("Trend_MAmt_60");

ObjectDelete("Trend_MAmt_240");

ObjectDelete("Trend_MAmt_1440");

ObjectDelete("Trend_MAmt_10080");

ObjectDelete("Trend_MAmt_43200");

ObjectDelete("Trend_MAlt_5");

ObjectDelete("Trend_MAlt_15");

ObjectDelete("Trend_MAlt_30");

ObjectDelete("Trend_MAlt_60");

ObjectDelete("Trend_MAlt_240");

ObjectDelete("Trend_MAlt_1440");

ObjectDelete("Trend_MAlt_10080");

ObjectDelete("Trend_MAlt_43200");

ObjectDelete("Trend_MAboll_5");

ObjectDelete("Trend_MAboll_15");

ObjectDelete("Trend_MAboll_30");

ObjectDelete("Trend_MAboll_60");

ObjectDelete("Trend_MAboll_240");

ObjectDelete("Trend_MAboll_1440");

ObjectDelete("Trend_MAboll_10080");

ObjectDelete("Trend_MAboll_43200");

ObjectDelete("Trend_CCI_5");

ObjectDelete("Trend_CCI_15");

ObjectDelete("Trend_CCI_30");

ObjectDelete("Trend_CCI_60");

ObjectDelete("Trend_CCI_240");

ObjectDelete("Trend_CCI_1440");

ObjectDelete("Trend_CCI_10080");

ObjectDelete("Trend_CCI_43200");

ObjectDelete("Trend_MACD_5");

ObjectDelete("Trend_MACD_15");

ObjectDelete("Trend_MACD_30");

ObjectDelete("Trend_MACD_60");

ObjectDelete("Trend_MACD_240");

ObjectDelete("Trend_MACD_1440");

ObjectDelete("Trend_MACD_10080");

ObjectDelete("Trend_MACD_43200");

ObjectDelete("Trend_ADX_5");

ObjectDelete("Trend_ADX_15");

ObjectDelete("Trend_ADX_30");

ObjectDelete("Trend_ADX_60");

ObjectDelete("Trend_ADX_240");

ObjectDelete("Trend_ADX_1440");

ObjectDelete("Trend_ADX_10080");

ObjectDelete("Trend_ADX_43200");

ObjectDelete("Trend_BULLS_5");

ObjectDelete("Trend_BULLS_15");

ObjectDelete("Trend_BULLS_30");

ObjectDelete("Trend_BULLS_60");

ObjectDelete("Trend_BULLS_240");

ObjectDelete("Trend_BULLS_1440");

ObjectDelete("Trend_BULLS_10080");

ObjectDelete("Trend_BULLS_43200");

ObjectDelete("Trend_BEARS_5");

ObjectDelete("Trend_BEARS_15");

ObjectDelete("Trend_BEARS_30");

ObjectDelete("Trend_BEARS_60");

ObjectDelete("Trend_BEARS_240");

ObjectDelete("Trend_BEARS_1440");

ObjectDelete("Trend_BEARS_10080");

ObjectDelete("Trend_BEARS_43200");

//—-

return(0);

}

//+——————————————————————+

//| Custom indicator iteration function |

//+——————————————————————+

int start()

{

double UP_1, UP_2, UP_3, UP_4, UP_5, UP_6, UP_7, UP_8, UP_9, UP_10;

double UP_11, UP_12, UP_13, UP_14, UP_15, UP_16, UP_17, UP_18, UP_19, UP_20;

double UP_21, UP_22, UP_23, UP_24, UP_25, UP_26, UP_27, UP_28, UP_29, UP_30;

double UP_31, UP_32, UP_33, UP_34, UP_35, UP_36, UP_37, UP_38, UP_39, UP_40;

double UP_41, UP_42, UP_43, UP_44, UP_45, UP_46, UP_47, UP_48, UP_49, UP_50;

double UP_51, UP_52, UP_53, UP_54, UP_55, UP_56, UP_57, UP_58, UP_59, UP_60;

double UP_61, UP_62, UP_63, UP_64;

double UP_65, UP_66, UP_67, UP_68;

double UP_69, UP_70, UP_71, UP_72;

double UP_73, UP_74, UP_75, UP_76;

double UP_77, UP_78, UP_79, UP_80;

double UP_81, UP_82, UP_83, UP_84;

double UP_85, UP_86, UP_87, UP_88;

double UP_89, UP_90, UP_91, UP_92;

double UP_93, UP_94, UP_95, UP_96;

double UP_97, UP_98, UP_99, UP_100;

double UP_101, UP_102, UP_103, UP_104;

double UP_105, UP_106, UP_107, UP_108;

double DOWN_1, DOWN_2, DOWN_3, DOWN_4, DOWN_5, DOWN_6, DOWN_7, DOWN_8, DOWN_9, DOWN_10;

double DOWN_11, DOWN_12, DOWN_13, DOWN_14, DOWN_15, DOWN_16, DOWN_17, DOWN_18, DOWN_19, DOWN_20;

double DOWN_21, DOWN_22, DOWN_23, DOWN_24, DOWN_25, DOWN_26, DOWN_27, DOWN_28, DOWN_29, DOWN_30;

double DOWN_31, DOWN_32, DOWN_33, DOWN_34, DOWN_35, DOWN_36, DOWN_37, DOWN_38, DOWN_39, DOWN_40;

double DOWN_41, DOWN_42, DOWN_43, DOWN_44, DOWN_45, DOWN_46, DOWN_47, DOWN_48, DOWN_49, DOWN_50;

double DOWN_51, DOWN_52, DOWN_53, DOWN_54, DOWN_55, DOWN_56, DOWN_57, DOWN_58, DOWN_59, DOWN_60;

double DOWN_61, DOWN_62, DOWN_63, DOWN_64;

double DOWN_65, DOWN_66, DOWN_67, DOWN_68;

double DOWN_69, DOWN_70, DOWN_71, DOWN_72;

double DOWN_73, DOWN_74, DOWN_75, DOWN_76;

double DOWN_77, DOWN_78, DOWN_79, DOWN_80;

double DOWN_81, DOWN_82, DOWN_83, DOWN_84;

double DOWN_85, DOWN_86, DOWN_87, DOWN_88;

double DOWN_89, DOWN_90, DOWN_91, DOWN_92;

double DOWN_93, DOWN_94, DOWN_95, DOWN_96;

double DOWN_97, DOWN_98, DOWN_99, DOWN_100;

double DOWN_101, DOWN_102, DOWN_103, DOWN_104;

double DOWN_105, DOWN_106, DOWN_107, DOWN_108;